In this post I want to provide my non-academic perspectives on the growth of securities margin lending over the past decade and its potential impact on market volatility. I think there are three important observations and one caveat here:

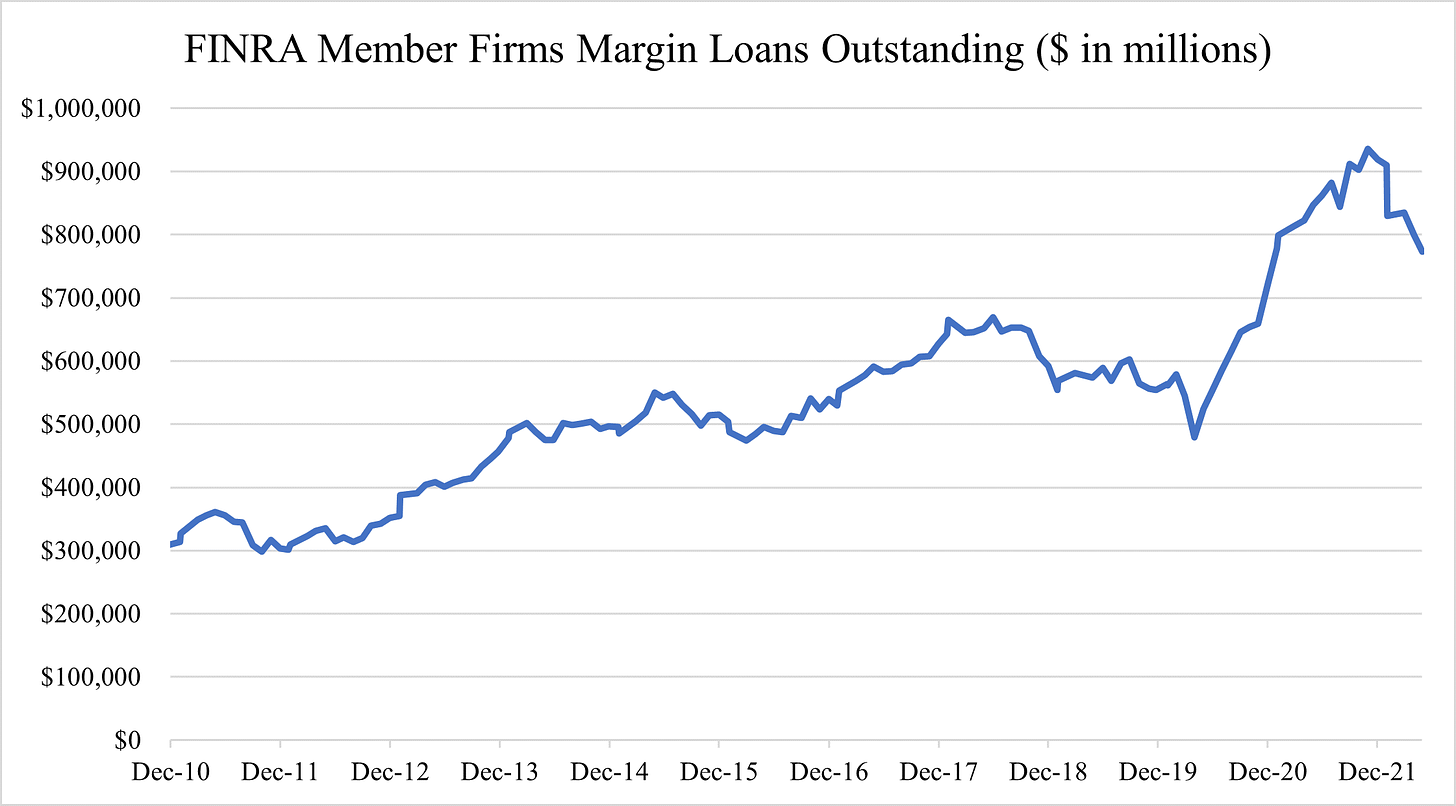

1) Margin lending has grown significantly over the past decade

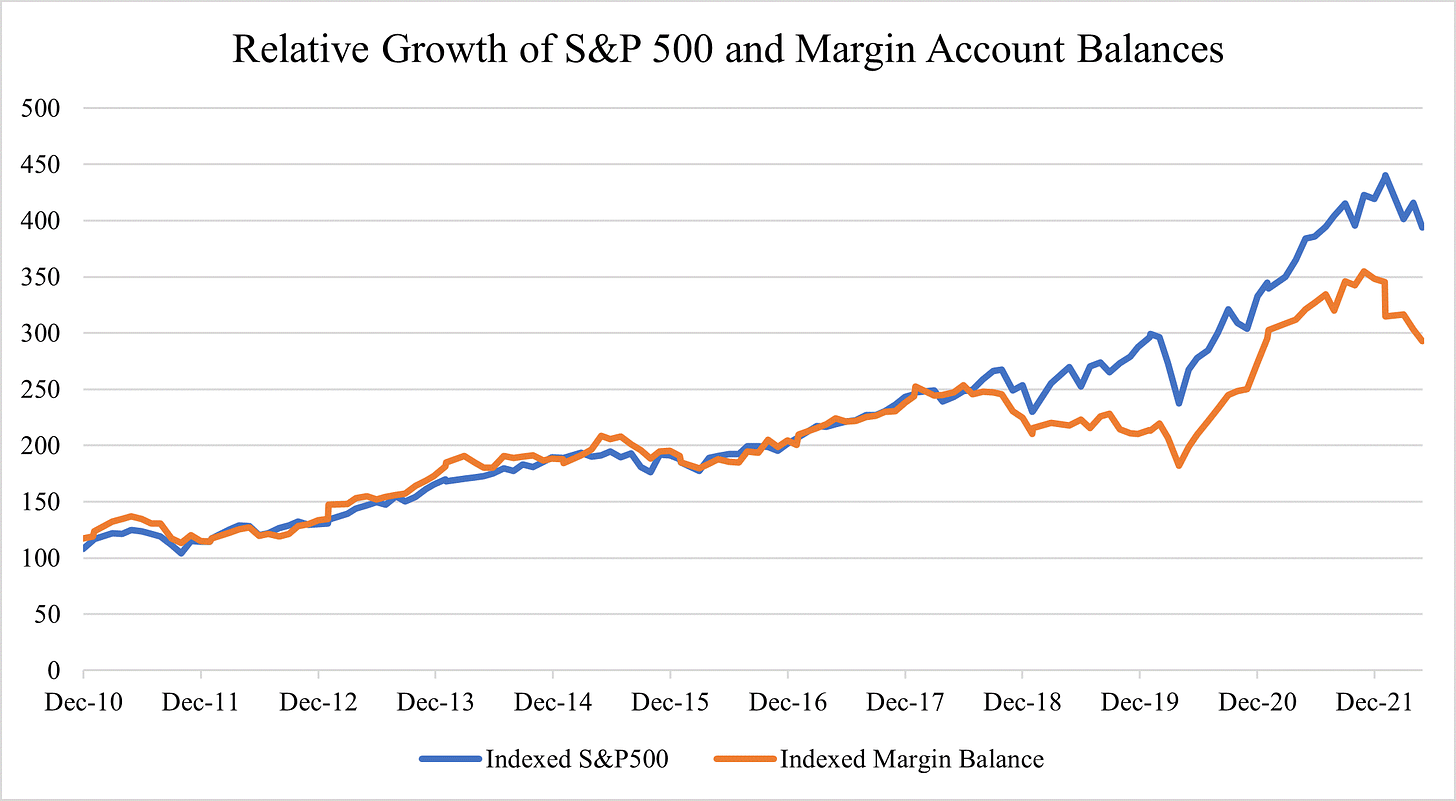

2) Margin lending and the S&P 500 grow hand-in-hand (although correlation doesn’t necessarily mean causation)

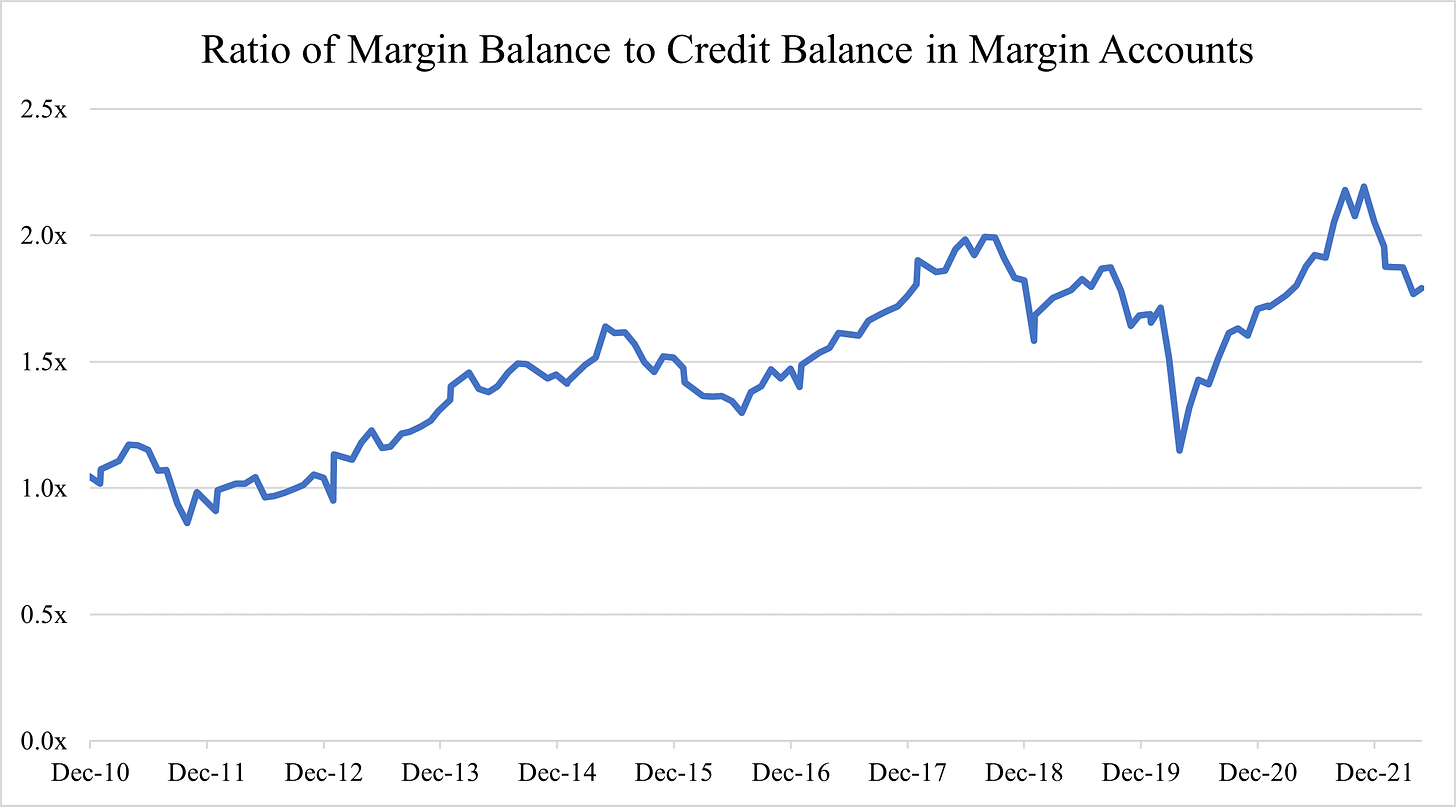

3) The amount of cash backing margin accounts has decreased

Margin Overview

Securities margin lending is a loan backed by securities in a brokerage account. For example, if you own $500 of Apple stock, a broker will generally allow you to use that stock as collateral for a loan to purchase additional shares or provide cash.

Margin loans are subject to a minimum equity requirement and if the value of the pledged securities and cash in an account drops below the minimum equity requirement, the broker reserves the right to request additional collateral or to sell securities in the account to repay the loan until the minimum equity requirement is met (proverbially called a “margin call”).1 Contrastingly, if the value of an account increases, the customer’s equity increases and their margin capacity for additional purchases increases.

A key feature of these loans is that the broker charges interest on the outstanding balance (generally at a spread to a benchmark interest rate), which makes them highly profitable for brokers. Because these loans are floating rate, their attractiveness for borrowers is very tied to the short-term interest rate environment. Another feature is that margin loans can be used to purchase any securities (stocks, bonds, options, etc.) and they can be used as a source of cash for non-securities purchases (e.g., vacation home, new car, unforeseen expenses, etc.).2

The Growth of Margin Lending

From the end of 2010 through April 2022, the total value of margin loans outstanding increased almost 3x, reaching a peak of $935 billion in October 2021 (a ~3.5x increase). There are a few noticeable pick-ups and declines in the total loan amount, which closely align with interest rate policy and movement in the S&P 500, including i) the beginning of the Fed’s quantitative easing program in 2012 and commitment to zero interest rates for an extended period of time, ii) the Fed’s taper in 2017/2019, iii) the “easy money” period during the COVID pandemic, and iv) the inflation/tapering market liquidation and volatility in 2022.

What all these swings have in common is their close correlation to funding costs and changes in the S&P 500 index. As margin strategies get cheaper or more expensive and as stocks go up and down, margin borrowers amplify the trend by creating additional buying or selling momentum with borrowed money.

One other important point to make is that over time, margin lending has become a more important revenue center for brokers. As brokers have done away with fixed trading commissions, they increasingly rely on lending products to make up for the lost revenue (in addition to payments for order flow). This is why your Schwab or Robinhood account makes it easy to receive approval for and begin trading in margin.

What is most interesting about the growth of margin lending is how its growth has been supported. In a traditional sense, investors would deposit cash into their bank account, use it to buy securities, and then use those securities as collateral for the loan. Under this construct, the ratio of margin loans to credit balances in customer accounts stays close to 1.0x, as there is one dollar of loan for one dollar of equity.3

However, what we see over the past 10 years is a divergence from that trend. Instead, investors are using appreciation from existing investments to fund additional margin borrowing. This limits the need to contribute cash to fund additional purchases but makes the borrowing much more dependent on the value of the underlying collateral. Given this dynamic, if the entire market declines, including the securities used as collateral for additional margin loans, margin portfolio equity will deteriorate at a fast pace.

For these two reasons, I believe we are seeing greater market volatility on both up and down market days. More traders have been using margin loans to fund their trading because they are easily accessible and cheap and this trading amplifies upswings. At the same, it creates the groundwork for greater volatility when the market broadly declines.4

The blunt force measure to lower volatility is higher funding costs for margin loans in the form of higher interest rates. Higher rates makes it more expensive to hold margin positions and can even make certain trades unprofitable (and even require them to be proactively unwound). We are seeing this play out in real time as the Fed raises interest rates and markets sell off. Indeed, margin loans have been a useful tool in amplifying returns for many investors over the past decade; however, they can just as equally wipe out a portfolio.

One final comment I’d like to make is I think the role that margin loans play in inflating the general economy is understated. Margin loans amplify the market’s upswings and generate realized gains or loan collateral value for security holders. Go to any broker website and you are offered the ability to take out a cash margin loan on the value of your portfolio that can be used to finance any type of purchase (Robinhood even offers a credit card that automatically creates a loan every time you make a purchase). During the past decade, and particularly the past two years, I believe a significant amount of consumption, particularly in “high-end” markets, has been funded in this manner. Look no further then the explosive growth in the price of luxury goods such as sporting and concert tickets, vacation homes, and luxury vehicles. It will be interesting to see if these trends continue as the securities markets broadly enter a downcycle and margin funding costs increase.

Disclaimer: These views are entirely my own personal opinion and are not intended to be and do not constitute investing advice or an offer to buy or sell a security.

The Federal Reserve requires 50% minimum initial equity with respect to stock purchases. Maintenance margin levels are lower, normally 30%. There are additional regulations around using margin for small dollar/penny stocks.

Margin accounts are tightly regulated by the Federal Reserve and financial industry regulatory bodies. Future posts will cover securities and asset backed lending outside of margin accounts, which is not as tightly regulated.

Margin trading is even more levered in foreign exchange and cryptocurrency markets. Borrowers can receive initial leverage as high as 30:1 depending on the asset.

There isn’t publicly available data on the composition of margin portfolios, but my hunch is that it mostly contains tech stocks. This explains, in part, why companies like Tesla and Meta exhibit such wild price swings.